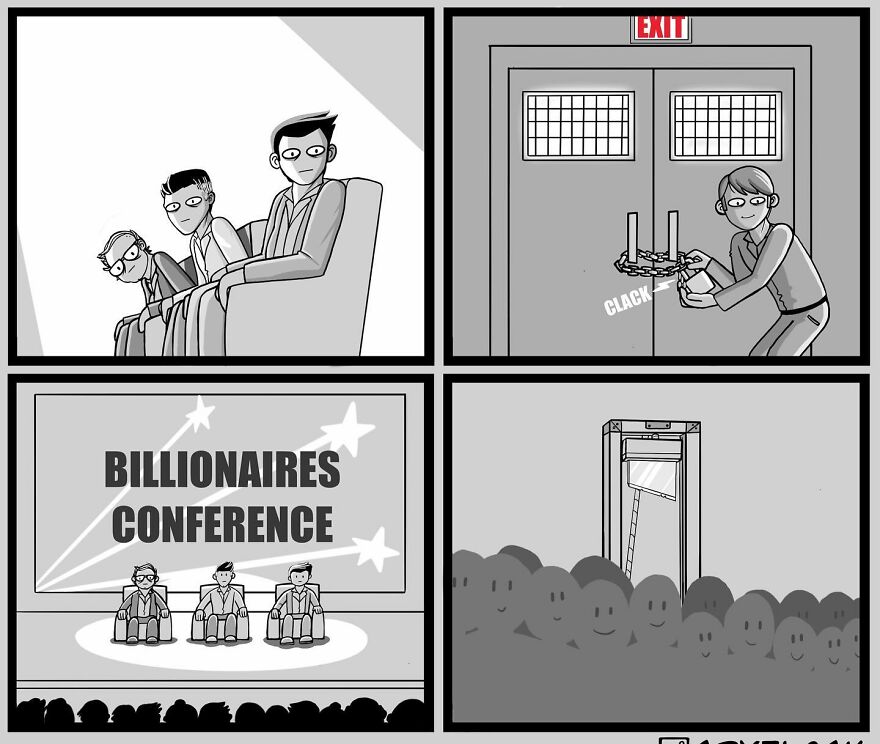

I'm not locked in here with you, you're locked in here with me!

-

[email protected]replied to [email protected] last edited by

It was pretty much just one of the options used for death penalty from what I understand. Then there’s the revolution bit but otherwise it was a state execution method used as late as 1977.

-

[email protected]replied to [email protected] last edited by

Additionally guillotines were seen as a more humane method of execution than the hangings and manual beheading of pre-Enlightenment France.

-

[email protected]replied to [email protected] last edited by

You can’t change the system while they own it and you can’t jail them when they own the prisons as well as the ones that should be putting them there.

What do you suggest?

-

[email protected]replied to [email protected] last edited by

I like how you think this is a realistic scenario.

-

[email protected]replied to [email protected] last edited by

Well, non violent seizing of the means via unionizing and community action via grassroots electorate driven by transparent mutual aid.

But once you sign on to get the executions starting, you better hope you’re in the “in group” all along. Else the violence will eventually come for you (not you you, hypothetical anyone)

And back to my point, the death penalty will just make them crafty, it won’t stop greed.

-

it’s intellectually fallacious to even suggest such a thing.

Is it.

-

[email protected]replied to JackGreenEarth last edited by

And hoarding money that would provide housing, food, and medicine while people are dying or barely living paycheck to paycheck for the lack of those things isn’t immoral? Lick the boot harder. They might give you a fucking dîme.

-

[email protected]replied to [email protected] last edited by

This would be ideal but I’m skeptical that it’s actually possible. Bribes are cheaper than taxes, so I think they’d likely just prevent the taxes from happening by greasing the correct palms.

-

[email protected]replied to [email protected] last edited by

Can’t shake the feeling that swapping panels 1 and 3 would make more sense.

-

[email protected]replied to [email protected] last edited by

Okay so once you’ve non violently seized the means, and they come to violently take them back, then what?

-

[email protected]replied to [email protected] last edited by

Well yeah, that’s exactly what’s happened for at least the past 50 years. In 1968 corporations were paying 53% of their profits in taxes, and billionaires were paying 94% around that time! Btw, if you’re making billions, paying 94% still leaves you richer than most…

Contrast that to today, where the system is so obviously broken during a time when Amazon is paying less in total taxes than a fry cook at McDonald’s.

It would need to be done with actually no loopholes, and meaningful enforcement of consequences for those who would try to cheat (perhaps the guillotine).

-

JackGreenEarthreplied to [email protected] last edited by

What? No, why would you assume those things about me. There are no ethical billionaires.

-

[email protected]replied to [email protected] last edited by

Don’t they already just avoid paying taxes by not having a salary and just using bank loans or something? So they have no actual money in the bank

-

[email protected]replied to [email protected] last edited by

Every healthy society requires a robust guillotine maintenance capability, ideally across all competencies.

-

[email protected]replied to [email protected] last edited by

If you’ve seized em you’ve seized em. The system is no longer available for their exploitation. So did you or didn’t you?

Again, have fun with the violence, but once that cat is out of the bag you always get 2 things:

- Spillover violence outside the “pure” original intentions

- Power vacuum

-

[email protected]replied to [email protected] last edited by

one big issue is everyone goes “you can’t tax stocks!” and then billionaires take a loan against the stocks with the unrealized gains as collateral. So we’d need to start classifying a loan as a realized gain of the collateral against this, with an exception for mortgages on primary domiciles, maybe also a “first million dollars are exempt,” calculated on the full debt of the borrower, not per loan. I can’t imagine anyone taking out more than $1M in debt against a properly they don’t live in is not the rich we need to be taxing.

-

[email protected]replied to [email protected] last edited by

That’s an insightful point, and honestly taxing those loans as realized gains sounds entirely reasonable. It’s good for the lenders because of reduced risk, it’s good for the rich because it keeps them honest, and it’s good for the public because we gain increased tax revenue from those who can most afford it. Nice!

-

[email protected]replied to [email protected] last edited by

Contrast that to today, where the system is so obviously broken during a time when Amazon is paying less in total taxes than a fry cook at McDonald’s.

Wait…by percentage, or by dollar amount?

-

[email protected]replied to [email protected] last edited by

Mostly by percentage, but I wouldn’t be surprised for the other one.

-

[email protected]replied to [email protected] last edited by

Nice dodge