Layaway

-

[email protected]replied to [email protected] last edited by

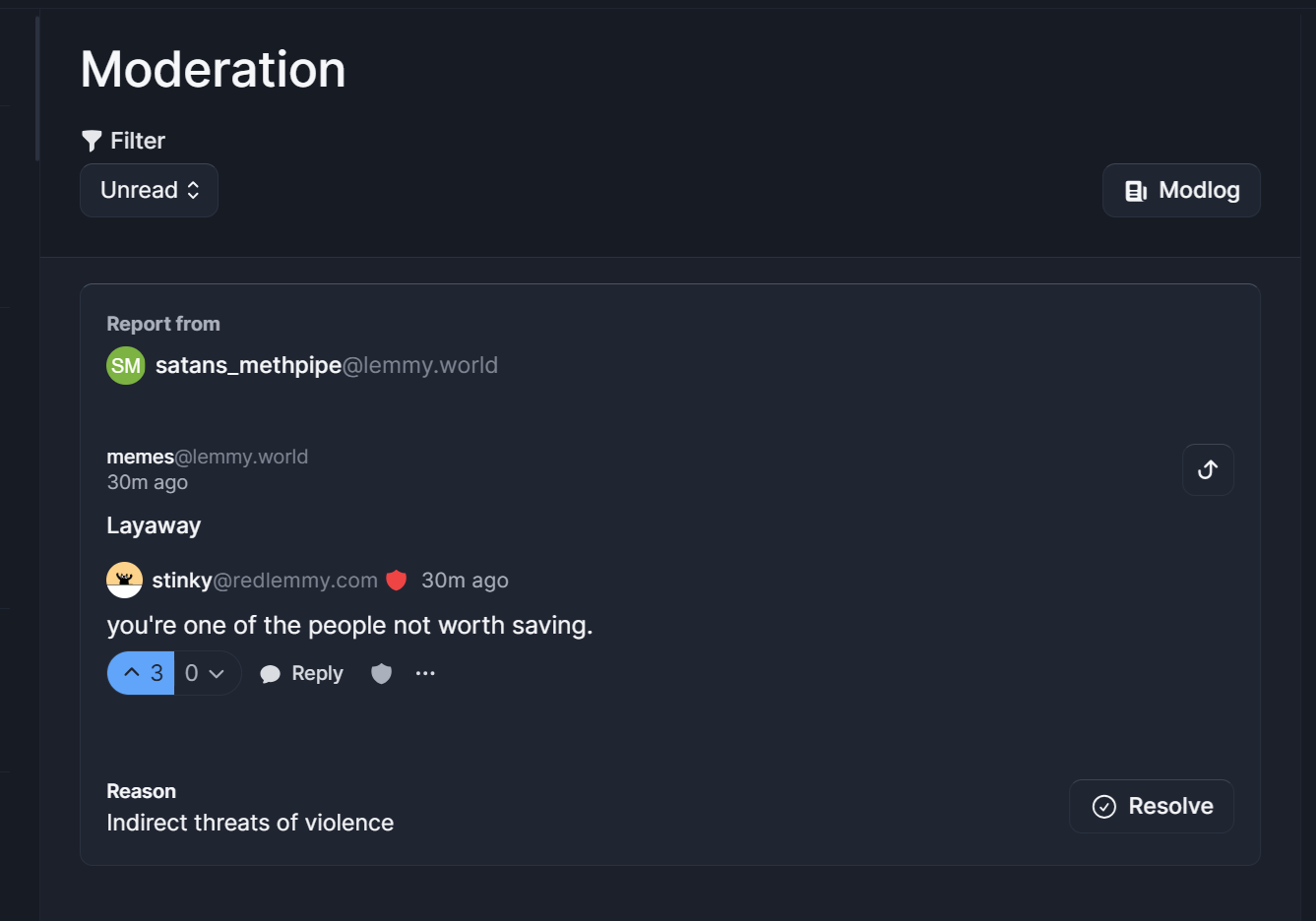

What do I need saving from? I kind of seems like you're threatening me with violence.

-

AwkwardLookMonkeyPuppetreplied to [email protected] last edited by

Yeah, that's problematic spending. How did she qualify for food stamps if her income was high enough to have $1000 to spend on boots? At one point in my life I was upside down after paying rent, insurance, utilities, and car payment, and was still told I had too much money when I applied for food stamps. I was literally upside down with negative dollars in my bank account, no job & no prospects due to recession, on unemployment, and the State said I had too much money.

-

[email protected]replied to [email protected] last edited by

You just reported me to myself, dumbshit.

-

[email protected]replied to [email protected] last edited by

This makes no sense, how can you have 1k to buy boots, but still have a low enough income to qualify for food stamps?

And you realize food stamps isn't something you can just get on when you realize you overspent that month, it's a months long process in many places with paperwork and income verification.

You sound like someone whos never had to deal with the welfare process at all and spout bullshit to discredit it like many right wing nuts like to do.

Shes probably your ex because she broke up with you, good for her.

-

[email protected]replied to [email protected] last edited by

The company I work for (in e-commerce) just recently started offering/advertising paying using Klarna.

If you don't know, (and you can probably guess given the context of this post), Klarna is a company that basically just allows users to buy now and pay over the course of a few weeks. "Buy this $100 item now and pay in four installments of $25 over four weeks" or some such. Anyone can get the app and it gives credit card numbers that will buy stuff online or whatever, and then the paying back process is that Klarna bills the customer over the course of a few weeks.

But companies can integrate with Klarna as well. When they do, Klarna makes everything work like it does with credit cards so the company doesn't have to completely retool to support Klarna as a payment method. And it's more convenient for the customer than dealing with the app and manually typing in the credit card number they get from the app.

Here's the thing, though. There's no interest charged to the customer. I think Klarna makes its money just because companies pay them money for integrations and for the ability to advertise that customers can buy now pay later and such. And at least in the case of my company's integration with Klarna, Klarna takes all the risk. They're lending customers money and hoping the customers pay it back. My employer gets the money up front and isn't out any money if the customer doesn't pay. And Klarna is huge. They're holding a whole lot of debt at any one time. And it's not secured debt or anything.

Really seems like a risky thing. Just like risky mortgages are. If a significant number of customers were to default on their debt at the same time (and not all Klarna purchases are $6 pizzas, some are multiple hundreds of dollars worth of debt), I'd imagine Klarna would be out of business quicker than Enron. Or maybe they'll be "too big to fail" by that point and they'll get a bailout.

Either way, it seems like a not-insignificant chunk of the economy is teetering atop the pencil-balanced-on-its-point that is Klarna. I'm not sure if there are a lot of other companies offering similar services, but if so, that just makes the economy seem that much more precarious.

-

[email protected]replied to [email protected] last edited by

Then put yourself in time out kiddo

-

[email protected]replied to [email protected] last edited by

Yes I realize it takes a long time to get approval. The paperwork started showing up at our house while she was doing that spending. My entire point was that she was abusing a welfare program.

-

[email protected]replied to [email protected] last edited by

I typically use Zip, which is the exact same thing, I don't tend to rail against it like most Lemmy seems to do. Maybe they make things a little too easy for those who are terrible with regular credit cards and debt management to begin with, but many around here equate them to loan sharks and Paycheck Lending/Car Title Loans type places and those are absolutely predatory as fuck. Klarna and Zip aren't even close, they're closer to credit cards if anything.

Since there's no interest (on zip there is a 4$ flat fee per order though, dunno if klarna does the same), it's basically just the classic saving up for what you want, but you get the item right away.

Say you wanted to buy a $100 item, you have the income to save for it 25$ every 2 weeks but not to take the entire load at once, Zip would be the same as saving 25$ every 2 weeks on your paydays, except you get the item right away. And unlike real predatory loan places, like you said it's all unsecured so if you default on it, eh oh well.

-

[email protected]replied to [email protected] last edited by

Abuse how though? That's a very important piece of information you've failed to give. Did she falsify her income on her application? Because that IS a felony. Did she come into some money after applying and just didn't report it? That's also a reportable offense.

Orrr was she on food stamps and as a result actually had some disposable income for once and spent it on things you didn't agree with? Because that's NOT abuse. It's the whole point of food stamps. You get a couple hundred for groceries every month and maybe that'll decrease the load so you can have some money for disposable income for once to spend on other things.

-

[email protected]replied to [email protected] last edited by

Far out these downvotes and comments. Some of these people need to grow up/have more birthdays and/or get a lesson in reading comprehension. If someone can afford designer boots and weed but won't buy groceries they have made a choice & they are taking advantage of the welfare system. When they do, the people in charge of the welfare system see this and tighten the purse strings and make it so that people who actually need it begin to suffer and miss out.

-

[email protected]replied to [email protected] last edited by

This reminds me of PayPal from 25ish years ago. There wasn't a convenient way to transfer money online and they built a solution. To achieve critical mass, they offered people $10 to sign up and a $10 referral bonus (if your friend get $10 and you get $10). PayPal burned a lot of investor money to do this, but it paid off when they became the dominant payment method for eBay auctions. In short, it was a costly investment that paid off.

Klarna is trying to become the PayPal of e-commerce, displacing credit cards (and PayPal) and becoming the default means of paying online. Once they start to slow in their growth, they can do the following:

- Charge merchant fees.

- Charge service fees.

- Charge interest, (waiving it for debit-like transactions).

- Offer purchaser subscriptions with enhanced features and reduced costs.

- Push exclusivity agreements by offering discounts against steep fees.

- Sell data.

This last point is particularly powerful because they also have the bill of sale, which most payment options don't. If they offer point-of-sale systems that also collect detailed data, it would further allow them to track people.

I suspect that they are classified in a way that existing restrictions on payment networks do not apply to them. E.g., they may technically be a lending company but act as a payment network. Lending companies aren't expected to work with the copious amounts of detailed data that stores and payment processors do (e.g., Payday Loan doesn't know I spent part of my loan on a suitcase of Bud Light). Imagine an insurance company knowing how many drinks your table bought at a restaurant, then holding it against you when you make a claim.

-

That's not how it works or how it is meant to work. Food assistance is provided based on income, not on whether or not you have the ability to save up for a nice pair of shoes. And, in fact, it is intended to help you be able to do so. All of your money shouldn't have to go to food.

-

[email protected]replied to [email protected] last edited by

I think you want a different chain, this is Papa John's, not Daddy Luigi's

-

UnfortunateShortreplied to [email protected] last edited by

I don't know about the US, but in Europe Domino's is ridiculously overpriced. Like, if you got a 50% off coupon, you are approaching normal pizza prices. And it's not even that good.

-

Sounds to me like they’re waiting for people to get used to this model for every purchase before they quietly add interest.

-

[email protected]replied to UnfortunateShort last edited by

Yea, that's a common thing with American fast food joints overseas IME. Whenever I've gone to another country and visited the local McDs or whatever it's always so expensive compared to the states.

Here dominos with coupon is often the cheapest around, not the greatest, but decent enough especially with one of those 50% off coupons

-

[email protected]replied to [email protected] last edited by

Don’t reports on Lemmy get sent to the mods, the instance admin and the user being reported?

-

I use affirm pretty often and usually there are options where you extend the term a few months but add interest. Haven't paid interest cause I have that luxury but being able to extend large purchases over 2-3 months without interest is amazing.

-

[email protected]replied to UnfortunateShort last edited by

Dominoes in the US is terrible. Is there quality better outside the US? Otherwise I don’t see how they could compete charging twice as much as other pizza places.

-

[email protected]replied to [email protected] last edited by

This isn't really relevant, other than to establish you have to be one broke bastard to need a pizza layaway, but Papa John's offers a carry out special large one topping for $9.99 in my area.

They also offer a large one topping for $8.99. Same exact pizza. No limitations.

Shaq's really putting that Purdue University degree to work I guess.