Layaway

-

[email protected]replied to [email protected] last edited by

My ex signed up for food stamps at one point. But she had new boots and plenty of weed to smoke.

-

[email protected]replied to [email protected] last edited by

Could be risky - you don’t want to end up upside-down on your pizza mortgage

-

-

[email protected]replied to [email protected] last edited by

Sounds like somebody isn't making the most out of their weekly slice...

-

-

-

[email protected]replied to [email protected] last edited by

I want to be upside down under Luigi

-

[email protected]replied to [email protected] last edited by

Don't ever criticize people who accept welfare. They are not the problem.

-

Fintechs are trying to get their grubby little claws into everyone who's desperate or stupid enough, so wouldn't surprise me at all if BNPL* companies are doing deals with takeaway places.

I genuinely pity anyone using this because they need to.

*Not sure about elsewhere, but in the UK this legal predatory practice is called Buy Now Pay Later. Online loan sharking without the broken kneecaps.

-

[email protected]replied to [email protected] last edited by

I already did and I will continue to do so. They prioritized purchasing weed and designer boots instead of buying groceries for themselves. That welfare money was for people that are actually struggling and not just pissing away their money without any consideration for the future.

-

AwkwardLookMonkeyPuppetreplied to [email protected] last edited by

As for the latter, sometimes you have no other options, so you do things that you know are financially bad decisions because otherwise you starve. When I was younger I'd knowingly write bad checks at the grocery store because I needed food and couldn't get it any other way. I'd have a paycheck coming in a few days, and knew I'd have to pay the fee, but it was that or starve.

-

AwkwardLookMonkeyPuppetreplied to [email protected] last edited by

If she can't afford footwear, weed, and food, then she is struggling. These are not lavish purchases. Did you know that corporations are the largest recipients of welfare in the country? We're talking hundreds of billions of dollars more than personal welfare payments.

-

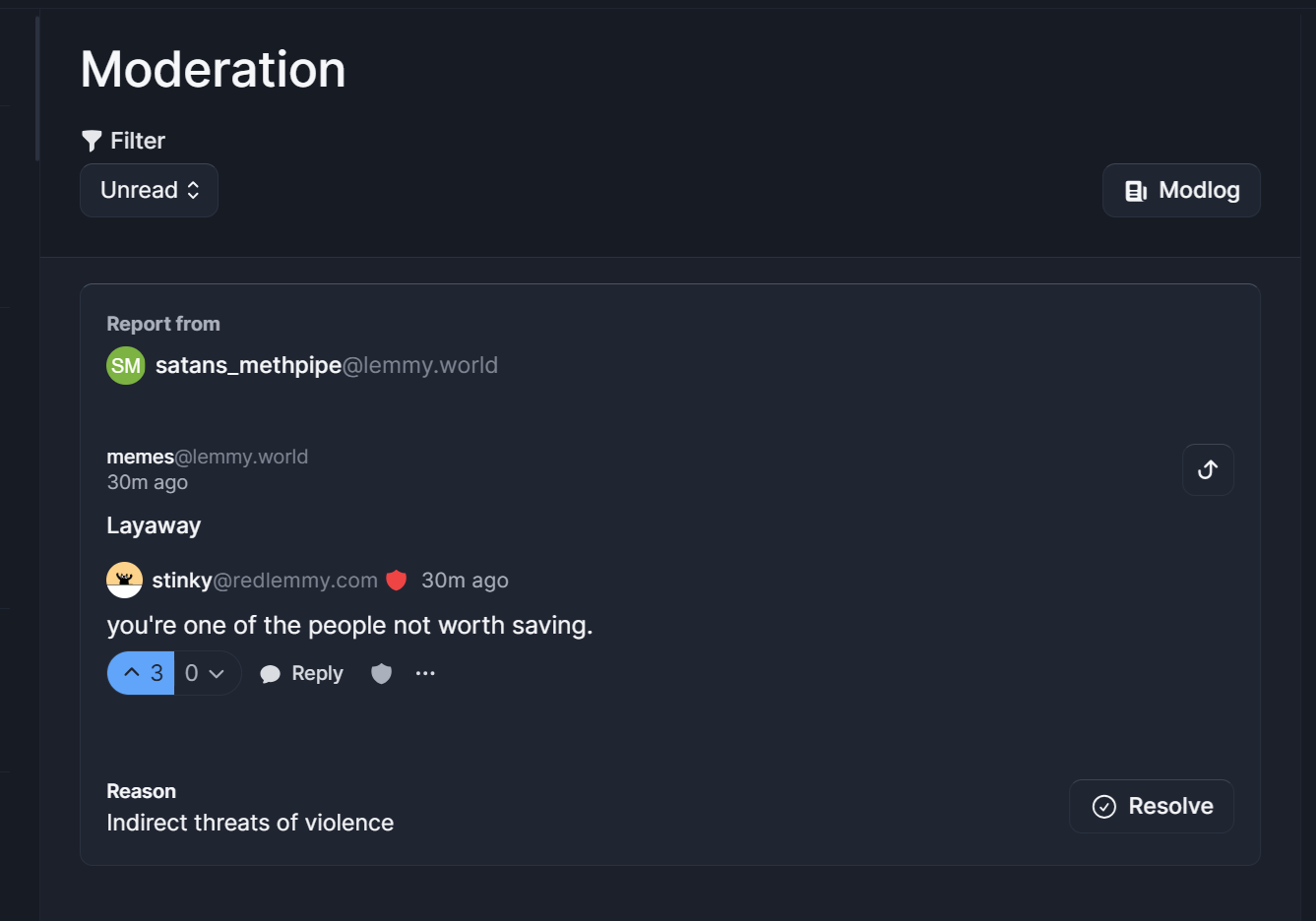

[email protected]replied to [email protected] last edited by

you're one of the people not worth saving.

-

[email protected]replied to AwkwardLookMonkeyPuppet last edited by

Buying close to $1,000 in footwear when all your other footwear is 100% functional and then realizing you need stamps to buy food is a problem.

-

[email protected]replied to [email protected] last edited by

What do I need saving from? I kind of seems like you're threatening me with violence.

-

AwkwardLookMonkeyPuppetreplied to [email protected] last edited by

Yeah, that's problematic spending. How did she qualify for food stamps if her income was high enough to have $1000 to spend on boots? At one point in my life I was upside down after paying rent, insurance, utilities, and car payment, and was still told I had too much money when I applied for food stamps. I was literally upside down with negative dollars in my bank account, no job & no prospects due to recession, on unemployment, and the State said I had too much money.

-

[email protected]replied to [email protected] last edited by

You just reported me to myself, dumbshit.

-

[email protected]replied to [email protected] last edited by

This makes no sense, how can you have 1k to buy boots, but still have a low enough income to qualify for food stamps?

And you realize food stamps isn't something you can just get on when you realize you overspent that month, it's a months long process in many places with paperwork and income verification.

You sound like someone whos never had to deal with the welfare process at all and spout bullshit to discredit it like many right wing nuts like to do.

Shes probably your ex because she broke up with you, good for her.

-

[email protected]replied to [email protected] last edited by

The company I work for (in e-commerce) just recently started offering/advertising paying using Klarna.

If you don't know, (and you can probably guess given the context of this post), Klarna is a company that basically just allows users to buy now and pay over the course of a few weeks. "Buy this $100 item now and pay in four installments of $25 over four weeks" or some such. Anyone can get the app and it gives credit card numbers that will buy stuff online or whatever, and then the paying back process is that Klarna bills the customer over the course of a few weeks.

But companies can integrate with Klarna as well. When they do, Klarna makes everything work like it does with credit cards so the company doesn't have to completely retool to support Klarna as a payment method. And it's more convenient for the customer than dealing with the app and manually typing in the credit card number they get from the app.

Here's the thing, though. There's no interest charged to the customer. I think Klarna makes its money just because companies pay them money for integrations and for the ability to advertise that customers can buy now pay later and such. And at least in the case of my company's integration with Klarna, Klarna takes all the risk. They're lending customers money and hoping the customers pay it back. My employer gets the money up front and isn't out any money if the customer doesn't pay. And Klarna is huge. They're holding a whole lot of debt at any one time. And it's not secured debt or anything.

Really seems like a risky thing. Just like risky mortgages are. If a significant number of customers were to default on their debt at the same time (and not all Klarna purchases are $6 pizzas, some are multiple hundreds of dollars worth of debt), I'd imagine Klarna would be out of business quicker than Enron. Or maybe they'll be "too big to fail" by that point and they'll get a bailout.

Either way, it seems like a not-insignificant chunk of the economy is teetering atop the pencil-balanced-on-its-point that is Klarna. I'm not sure if there are a lot of other companies offering similar services, but if so, that just makes the economy seem that much more precarious.

-

[email protected]replied to [email protected] last edited by

Then put yourself in time out kiddo