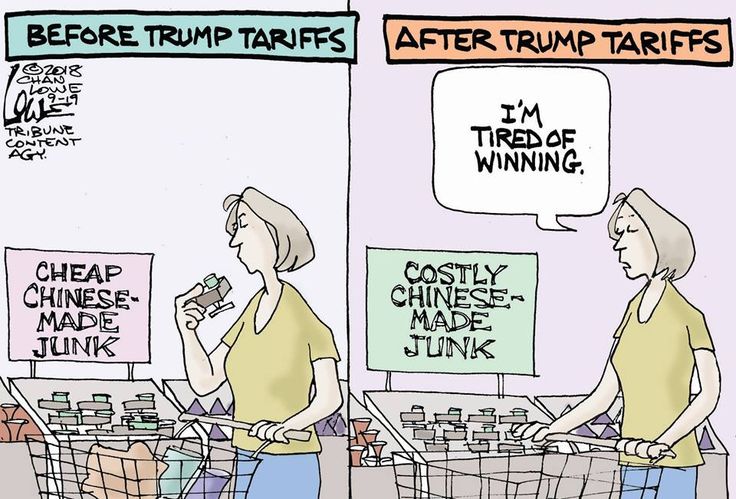

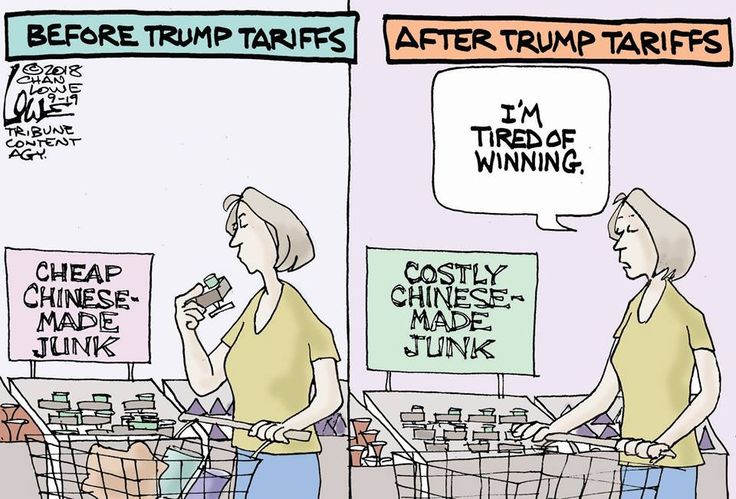

Winning

-

Sure thing, stretch.

The Nov 6 election returned both a popular vote and huge electoral victory for maga, The GOP made gains almost everywhere, and 6 million , or so, Biden voters didn't bother to vote.

Hence, those inside America chose.I preferred my original few words, but hey.

Fee-fees. -

This post did not contain any content.

-

Sometimes you have to cut out the cancer and then let it heal.

-

He’s already planned tax “cuts” that only cut taxes for those making north of $500k/yr. They go up for everyone under that. So we got both!

-

This seems very odd... Can you give me a source on that? Both the shredding of federal tax income and the relation to public expenditure? It appears I have much to learn

-

This seems very odd... Can you give me a source on that? Both the shredding of federal tax income and the relation to public expenditure? It appears I have much to learn

-

Very far on the outside.

-

We live in interesting times, no doubt about it.

-

Surely, if printing money (theoretically) causes inflation; and if collecting taxes reduces inflation, then the two are somewhat closely related.

If the amount of money that can be created by the government is somewhat limited, then surely tax money is another valid source for that money.

-

This post did not contain any content.

-

This post did not contain any content.

-

Frankly the whole thing needs an overhaul. Between land having more of a say than people, a structure for congress that hasn't appropriately resized, FPTP voting... Its a mess.

You can easily end up with the tyranny of the minority as a result.

-

Egg prices

-

Egg prices

The Trump administration is destroying our great nation's thick milfs

-

That makes for an interesting take to things, however it's simply an inverted way to think of paying for a debt incurred. Without the repayment by government revenue you would simply have acquisition by the government without a means to compensate for it.

The materials purchased have a cost. That cost is paid by the money created by the government. If the government simply continues to create an unbound supply of money then the currency becomes worthless and you end up with a hyper inflation cycle. See places like Zimbabwe or Venezuela where at some point you end up paying thousands of the sovereign currency for basic items. That currency volume needs to be maintained at some reasonable level for it to have any meaningful exchange value to another party.

So while it may not be directly input/output as the general population would see it, you could instead see it as a credit card. A limit is available on a card and to use it you must have available credit which is freed up by repayment of previous purchases.

Now, the fed through congress has the unique ability to extend their limit on demand, that still increases the debt load and associated interest payments, which is visible in the form of treasury bonds due and payable with accrued interest to the holder of those bonds. Those bonds are public debt, often held by foreign governments, but also by private sector investors, both which are assured payment by the credit worthiness of the government. This all is why there's such a fuss when talk of the government defaulting their debt comes about, the credit rating of the government, and why we have regular fights over extending that debt ceiling.