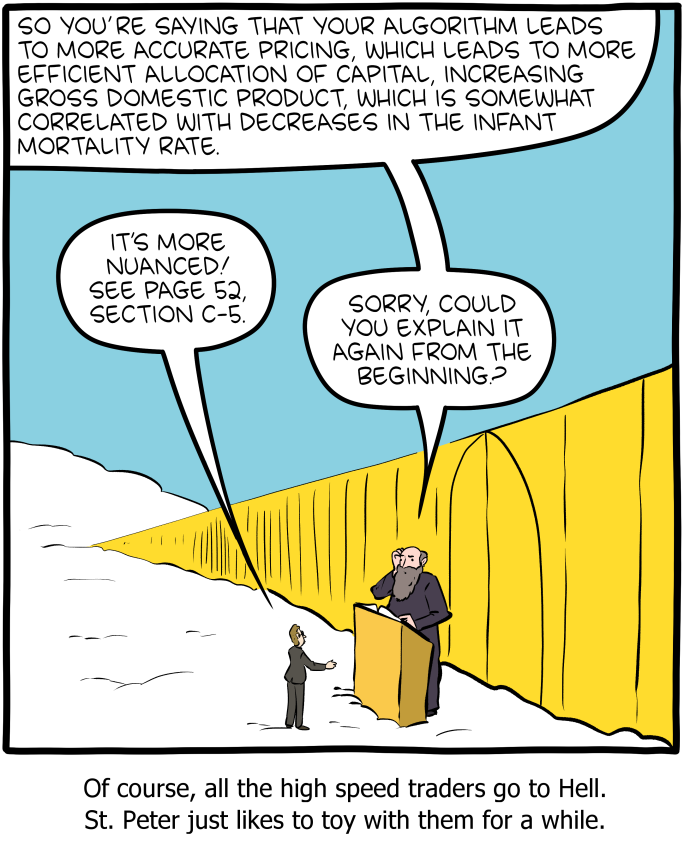

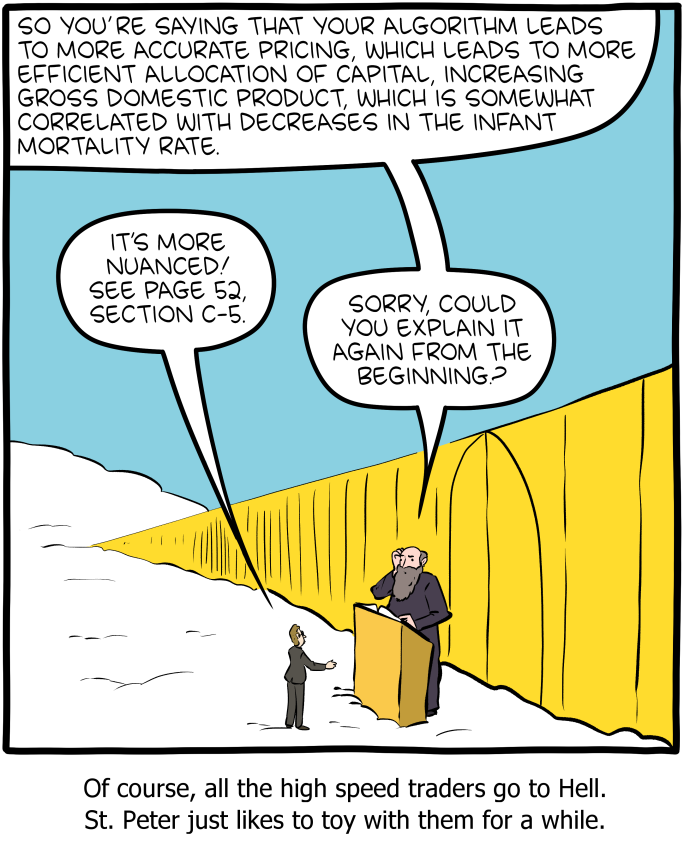

Capital [Saturday Morning Breakfast Cereal]

-

Before reading the caption, I thought this was a Brian Thompson comic. I thought Brian here was explaining why United Healthcare stock price increases are good for society.

-

I'm not a proponent of communism at this point, but I'd be very interested to see what the computer power of all stock markets of the world could do if harnessed to solve the problem of centralized resource allocation.

-

[email protected]replied to [email protected] last edited by

I doubt the market itself has crazy amounts of computer power, but the financial firms that run algorithms to trade in milliseconds to sell a million shares to make $100k on a small bump, there's a lot of power there. It's really all about speed.

They ran brand new undersea fiber to connect London to New York so the programs the corporations there run can trade milliseconds faster.

-

[email protected]replied to [email protected] last edited by

Don't you have to keep records of every transaction and report them to the IRS ?

-

[email protected]replied to [email protected] last edited by

I think if you do this legally, you'll have to pay taxes every time because you're earning a dollar

-

[email protected]replied to [email protected] last edited by

It's more nuanced! See page 52, section C-5.

-

[email protected]replied to [email protected] last edited by

I dunno. I’m not suggesting that what they do is illegal, just that it’s useless profit skimming from the inherent inefficiencies of humans getting together to make deals. Before high speed trading, it would just be noise in the line that would level out within minutes or even seconds, but these guys can tell their computers to trade pretty much instantly, and make money off banal shit like “mutual fund X starts their daily 401k purchases right after lunch, and it takes them Y minutes to finish them, so if you see Z orders coming in, have the computer trade at certain threshold and make a few cents.

I’m making that scenario up, and they’re constantly competing with regulators and other firms so it might not even be viable, but the granularity and timeframe and how stupid it is to be able to reliably make money off that kind of variance is very real. Humanity doesn’t move that fast, and there’s nothing of value to society from doing a blackjack rake like that. It’s a fairly small part of the overall market, but it’s just money and brainpower being sucked out of the system for no reason whatsoever.

-

[email protected]replied to [email protected] last edited by

Why doesnt the gouvernment let you not pay taxes so they can brag about being the richest country

-

[email protected]replied to [email protected] last edited by

The data of the buying/selling would be tracked by software via the stock broker, which would aggregate into a tax form via other software, and then be imported into their taxes by more software.

I think a 1099B at the end of the year coming from whatever company they are using would cover it.

-

From the position of privilege equality looks like loss

-

The thing that gets me about HFT is that the market itself could automatically facilitate price inversion trades. There's literally zero need for these middlemen.